Hospitality Financial Accounting, Second Edition

基本信息

Format:Hardback 544 pages

Publisher:John Wiley & Sons Inc

Imprint:John Wiley & Sons Inc

Edition:2nd Edition

ISBN:9780470083604

Published:13 Feb 2008

Classifications:Financial accounting, Hospitality industry

Readership:Professional & Vocational

Weight:1292g

Dimensions:284 x 220 x 23 (mm)

頁面參數僅供參考,具體以實物為準

書籍簡介

As the hospitality field continues to grow and diversify, today’s hospitality professionals need to understand financial accounting at a higher level than ever before. Written by some of the most respected authors in accounting, Hospitality Financial Accounting, Second Edition gives a complete introduction to financial accounting principles and demonstrates how to apply them to all facets of the hospitality industry.

Updated with the latest developments in the accounting and hospitality fields,Hospitality Financial Accounting, Second Edition covers the basics of financial accounting first and then shows hospitality students how to analyze financial statements and deal with the daily issues they will face on the job.

NEW TO THIS EDITION

Features a new dedicated chapter on financial statement analysis

Includes actual financial statements of PepsiCo are included and referred to throughout

New case studies cover a variety of hospitality enterprises doing business today

The view of the hospitality industry is expanded to such businesses as casinos, spas, and purveyors

Features an expanded section on ethics with real-world cases

Provides new Accounting in Action vignettes from hospitality and online companies support the concepts being discussed

Applied exercises that demonstrate the relevance of accounting to hospitality businesses

Appendices that discuss subsidiary ledgers and special journals

All end-of-chapter exercises have been revised and updated, and new ones added

FEATURES

Adapted from the market-leading textbook on financial accounting

Offers material on accounting and the hospitality industry, payroll, and the uniform system of accounts and financial reporting

Presents full-color interior with strong pedagogy, including Feature Stories, Chapter Objectives, Chapter Preview, Key Terms and Equations, Before You Go On practice problems, Technology box feature, and International Notes

Includes Demonstration Problems that give immediate practice, Financial Reporting Problems that use the PepsiCo financial statement, and Group Decision Cases that develop teamwork and group decision making skills

Features applied, user-oriented exercises that demonstrate the relevance of accounting to hospitality students

Includes scores of helpful drawings, charts, and tables

Utilizes a learning system called The Navigator that provides a checklist of the learning aides and study skills in each chapter, enabling students to set priorities and check their progress

Student website with review questions, self-study questions, and additional practice exercises

目錄

CHAPTER 1 HOSPITALITY ACCOUNTING IN ACTION 1

FEATURE STORY: Financial Reporting: A Matter of Trust 1

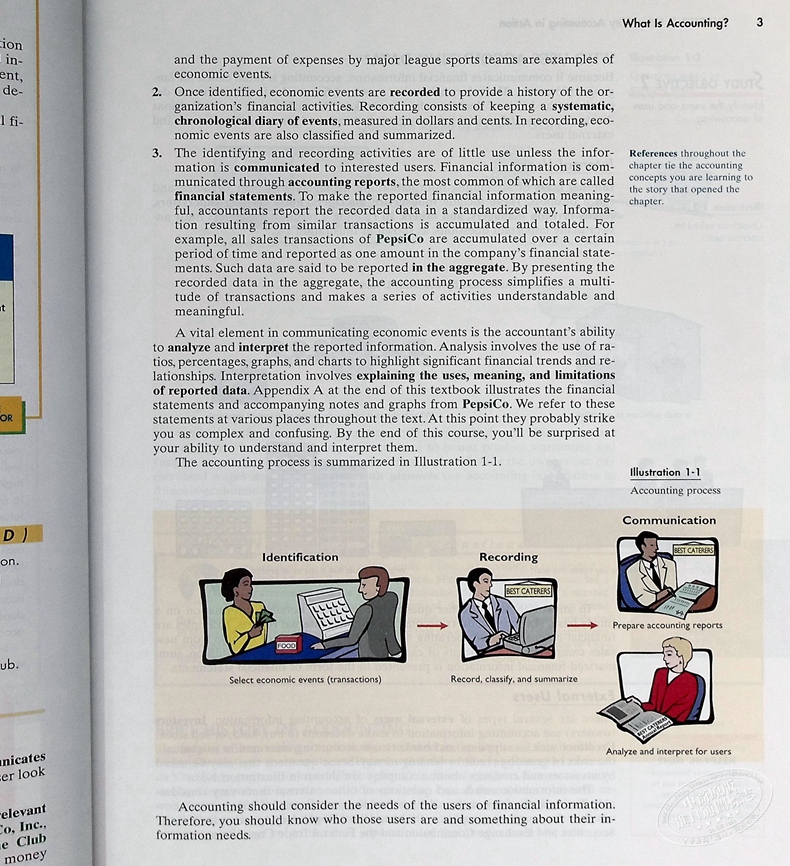

What Is Accounting? 2

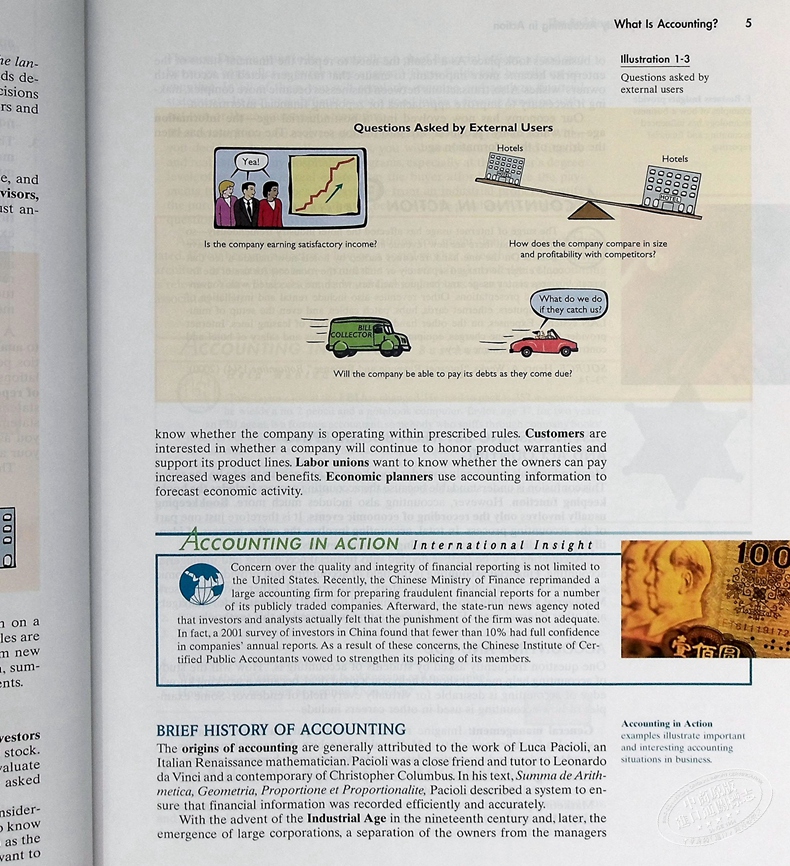

Who Uses Accounting Data? 4

Brief History of Accounting 5

Distinguishing between Bookkeeping and Accounting 6

Accounting and You 6

The Building Blocks of Accounting 7

Ethics—A Fundamental Business Concept 8

Generally Accepted Accounting Principles 8

Assumptions 9

Basic Accounting Equation 11

The Accounting Cycle and the Flow of Information 14

The Uniform System of Accounts and Financial Reporting 15

Lodging Industry 16

Foodservice Industry 16

Club Industry 16

Spa Industry 16

Gaming Industry 17

Accounting and Financial Management in Hospitality 17

Hotel Operations 17

Hotel Accounting Department Organization 20

Foodservice Operations 22

Club Operations 23

Appendix The Accounting Profession 25

Public Accounting 26

Private Accounting 26

Not-for-Profit Accounting 26

CHAPTER 2 ACCOUNTING PRINCIPLES 30

FEATURE STORY: Certainly Worth Investigating! 31

The Conceptual Framework of Accounting 32

Objectives of Financial Reporting 33

Qualitative Characteristics of Accounting Information 34

Elements of Financial Statements 35

Operating Guidelines 36

Assumptions 36

Monetary Unit Assumption 37

Economic Entity Assumption 37

Time Period Assumption 37

Going Concern Assumption 37

Principles 37

Revenue Recognition Principle 38

Matching Principle (Expense Recognition) 38

Full Disclosure Principle 40

Cost Principle 40

Constraints in Accounting 41

Materiality 42

Conservatism 42

Summary of Conceptual Framework 42

Financial Statement Presentation—An International Perspective 43

Using the Building Blocks 44

Transaction Analysis 45

Summary of Transactions 50

Financial Statements 52

Income Statement 52

Retained Earnings Statement 52

Balance Sheet 54

Statement of Cash Flows 54

CHAPTER 3 THE RECORDING PROCESS 66

FEATURE STORY: No Such Thing as a Perfect World 67

The Account 68

Debits and Credits 69

Debit and Credit Procedures 69

Stockholders’ Equity Relationships 72

Expansion of the Basic Equation 73

The Accounting Cycle 73

Steps in the Recording Process 74

The Journal 75

The Ledger 77

The Recording Process Illustrated 81

Summary Illustration of Journalizing and Posting 87

The Trial Balance 88

Limitations of a Trial Balance 89

Locating Errors 91

Use of Dollar Signs 91

Electronic Data Processing 92

Comparative Advantages of Manual versus Computerized Systems 92

A Look into the Future 93

CHAPTER 4 ADJUSTING THE ACCOUNTS 102

FEATURE STORY: Timing Is Everything 103

Timing Issues 104

Selecting an Accounting Time Period 105

Fiscal and Calendar Years 105

Accrual- versus Cash-Basis Accounting 105

Recognizing Revenues and Expenses 106

The Basics of Adjusting Entries 107

Types of Adjusting Entries 108

Adjusting Entries for Prepayments 108

Adjusting Entries for Accruals 115

Summary of Basic Relationships 120

The Adjusted Trial Balance and Financial Statements 122

Preparing the Adjusted Trial Balance 122

Preparing Financial Statements 122

Alternative Treatment of Prepaid Expenses and Unearned Revenues 124

Prepaid Expenses 124

Unearned Revenues 126

Summary of Additional Adjustment Relationships 127

CHAPTER 5 COMPLETION OF THEACCOUNTING CYCLE 136

FEATURE STORY: Everyone Likes to Win 137

Using a Work Sheet 138

Steps in Preparing a Work Sheet 138

Preparing Financial Statements from a Work Sheet 141

Preparing Adjusting Entries from a Work Sheet 144

Closing the Books 144

Preparing Closing Entries 145

Closing Entries, Illustrated 147

Posting of Closing Entries 147

Preparing a Postclosing Trial Balance 149

Summary of the Accounting Cycle 150

Correcting Entries—An Avoidable Step 151

Classified Balance Sheet 154

Standard Classifications 154

Classified Balance Sheet, Illustrated 158

CHAPTER 6 FINANCIAL STATEMENTS 168

FEATURE STORY: Cash Is King 169

The Income Statement 170

Multiple-Step Income Statement 170

Single-Step Income Statement 174

Departmental Income Statement 175

Consolidated Income Statement 176

Classified Balance Sheet 176

Relationship between the Income Statement and the Balance Sheet 177

The Statement of Cash Flows: Purpose and Format 178

Purpose of the Statement of Cash Flows 178

Meaning of Cash Flows 179

Classification of Cash Flows 179

Significant Noncash Activities 180

Format of the Statement of Cash Flows 181

Usefulness of the Statement of Cash Flows 182

Preparing the Statement of Cash Flows 183

Indirect and Direct Methods 183

Indirect Method for Statement of Cash Flows 185

First Year of Operations—2008 185

Second Year of Operations—2009 189

CHAPTER 7 FINANCIAL STATEMENT ANALYSIS 204

FEATURE STORY: “Follow That Stock!” 205

Basics of Financial Statement Analysis 206

Need for Comparative Analysis 206

Tools of Financial Statement Analysis 207

Horizontal Analysis 207

Balance Sheet 208

Income Statement 208

Retained Earnings Statement 210

Vertical Analysis 210

Balance Sheet 210

Income Statement 211

Ratio Analysis 213

Liquidity Ratios 214

Profitability Ratios 217

Solvency Ratios 220

Summary of Ratios 221

Limitations of Financial Statement Analysis 222

Estimates 222

Cost 222

Alternative Accounting Methods 223

Atypical Data 223

Diversification of Firms 223

CHAPTER 8 ACCOUNTING FOR MERCHANDISINGOPERATIONS IN HOSPITALITY 232

FEATURE STORY: Selling Dollars for 85

Cents 233

Merchandising Operations 234

Operating Cycles 235

Inventory Systems 236

Recording Purchases of Merchandise 238

Purchase Returns and Allowances 240

Freight Costs 241

Purchase Discounts 241

Recording Sales of Merchandise 243

Sales Returns and Allowances 244

Sales Discounts 245

Completing the Accounting Cycle 246

Adjusting Entries 246

Closing Entries 247

Summary of Merchandising Entries 247

Work Sheet for a Merchandiser 248

Using a Work Sheet 248

CHAPTER 9 INVENTORIES AND COST OF GOODSCALCULATION 260

FEATURE STORY: $12,800 Worth of Blueberry Muffins! 261

Inventory Basics 262

Classifying Inventory 263

Determining Inventory Quantities 263

Inventory Accounting Systems 265

Periodic Inventory System 266

Recording Transactions 266

Recording Purchases of Merchandise 266

Recording Sales of Merchandise 267

Cost of Goods Sold 268

Determining Cost of Goods Purchased 268

Transfers In and Out 270

Food Cost Calculations 271

Beverage Cost Calculations 271

Income Statement Presentation 272

Inventory Costing under a Periodic Inventory System 273

Using Actual Physical Flow Costing— Specific Identification 273

Using Assumed Cost-Flow Methods—FIFO, LIFO, and Average Cost 274

Financial Statement Effects of Cost-Flow Methods 278

Using Inventory Cost-Flow Methods Consistently 280

Inventory Errors 281

Income Statement Effects 281

Balance Sheet Effects 282

Statement Presentation and Analysis 282

Presentation 282

Analysis 283

CHAPTER 10

INTERNAL CONTROL AND CASH 288

FEATURE STORY: Minding the Money in Moose Jaw 289

Internal Control 290

Principles of Internal Control 291

Limitations of Internal Control 296

Cash Controls 296

Internal Control over Cash Receipts 297

Internal Control over Cash Disbursements 300

Use of a Bank 302

Making Bank Deposits 302

Writing Checks 302

Bank Statements 304

Reconciling the Bank Account 305

CHAPTER 11 PAYROLL 318

FEATURE STORY: Payroll: A Manageable Cost in the Hospitality Industry 319

Payroll Defined 320

Internal Control of Payroll 320

Hiring Employees 321

Timekeeping 321

Preparing the Payroll 323

Paying the Payroll 323

Fair Labor Standards Act 323

Determining the Payroll 324

Gross Earnings 324

Payroll Deductions 325

Net Pay 327

Recording the Payroll 327

Maintaining Payroll Department Records 327

Recognizing Payroll Expenses and Liabilities 329

Recording Payment of the Payroll 329

Tipped Employees 330

Tip Reporting 331

Employer Payroll Taxes 336

FICA Taxes 336

Federal Unemployment Taxes 336

State Unemployment Taxes 337

Recording Employer Payroll Taxes 337

Filing and Remitting Payroll Taxes 338

CHAPTER 12 ACCOUNTING FOR RECEIVABLESAND PAYABLES 346

FEATURE STORY: Financing His Dreams 347

Accounts Receivable 348

Types of Receivables 348

Recognizing Accounts Receivable 349

Valuing Accounts Receivable 350

Disposing of Accounts Receivable 357

Credit Policies 360

The Credit Department 360

The Credit Policy before, during, and after the Event 360

City Ledger of a Hotel 361

Notes Receivable 361

Determining the Maturity Date 362

Computing Interest 363

Recognizing Notes Receivable 364

Valuing Notes Receivable 364

Disposing of Notes Receivable 364

What Is a Current Liability? 367

Notes Payable 367

Sales Tax Payable 368

Payroll and Payroll Taxes Payable 369

Unearned Revenues 371

Current Maturities of Long-Term Debt 371

CHAPTER 13 LONG-TERM ANDINTANGIBLE ASSETS 380

FEATURE STORY: Time to Relax 381

Long-Term Assets 383

Determining the Cost of Long-Term Assets 383

Land 384

Land Improvements 384

Buildings 384

Equipment 385

Depreciation 386

Revising Periodic Depreciation 394

Expenditures during Useful Life 395

Long-Term Asset Disposals 396

Intangible Assets 401

Patents 402

Copyrights 402

Trademarks and Trade Names 402

Franchises and Licenses 403

Goodwill 403

CHAPTER 1 4 SOLE PROPRIETORSHIPS,PARTNERSHIPS, ANDCORPORATIONS 410

FEATURE STORY: “Two All Beef Patties, Special Sauce, Lettuce, Cheese, Pickles, Onions on a Sesame Seed Bun” 411

Sole Proprietorships 412

Partnerships 413

Association of Individuals 413

Mutual Agency 413

Limited Life 414

Unlimited Liability 414

Co-ownership of Property 414

Advantages and Disadvantages of a Partnership 414

The Partnership Agreement 415

Formation of a Partnership 415

Division of Net Income or Net Loss 416

Partnership Financial Statements 419

The Corporate Form of Organization and Stock Transactions 420

Characteristics of a Corporation 420

Forming a Corporation 424

Corporate Capital 424

Accounting for Common Stock Issues 429

Accounting for Treasury Stock 432

Preferred Stock 436

Dividends 438

Cash Dividends 438

Stock Dividends 441

Entries for Stock Dividends 442

Effects of Stock Dividends 443

Stock Splits 443

Retained Earnings 445

Retained Earnings Restrictions 446

Prior Period Adjustments 447

Retained Earnings Statement 447

APPENDIX A

SPECIMEN FINANCIAL STATEMENTS: PepsiCo, Inc. 454

APPENDIX B

SUBSUDIARY LEDGERS AND SPECIAL JOURNALS 482

FEATURE STORY: Different Roads for Different Folks 483

Expanding the Ledger—Subsidiary Ledgers 484

Nature and Purpose of Subsidiary Ledgers 484

Example 485

Advantages of Subsidiary Ledgers 486

Expanding the Journal—Special Journals 487

Sales Journal 488

Cash Receipts Journal 490

Purchases Journal 495

Cash Payments Journal 496

Effects of Special Journals on the General Journal 498

Photo Credits 505

Index 507

作者簡介

Jerry J. Weygandt, Ph.D., C.P.A., is the Arthur Andersen Alumni Professor of Accounting at the University of Wisconsin–Madison.

Donald E. Kieso, Ph.D., C.P.A., is the KPMG Emeritus Professor of Accounting at Northern Illinois University.

Paul D. Kimmel, Ph.D., C.P.A., is an Associate Professor of Accounting at the University of Wisconsin–Milwaukee.

Agnes L. DeFranco, Ed.D., C.H.E., is a Professor in the Conrad N. Hilton School of Hotel and Restaurant Management at the University of Houston.

評論曬單